33+ property tax in mortgage payment

Property assessments include two components-the. Web A no-income-verification mortgage is a home loan that doesnt require the documentation that standard loans typically require like pay stubs W2s or tax returns.

Should You Leave Your Tax And Insurance Payments In Escrow

In the city of Burlington the total.

. Web Better budgeting. Web As Rocket Mortgage explains a mortgage interest deduction helps incentivize homeownership. Explore Our Mortgage Calculators Find The Best Loan Term For You.

This calculation only includes principal and interest but does. Web Property taxes are considered part of the cost of owning a home and should be factored in when calculating monthly mortgage payments. Web The most significant factor affecting your monthly mortgage payment is the interest rate.

Bank We Can Help You Find A Mortgage Payment That Works For You. Web Your monthly mortgage payment probably includes property taxes. Your lender will estimate your property taxes and add that amount to the sum withdrawn from your account as your mortgage payment which.

In some cases borrowers may put down as low as 3. If you buy a home with a loan for 200000 at 433 percent your monthly payment on a 30. Web If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480.

Web Mortgage payment equation Principal Interest Mortgage Insurance if applicable Escrow if applicable Total monthly payment The traditional monthly mortgage. Web Typically mortgage lenders want the borrower to put 20 or more as a down payment. If you qualify for a.

The mortgage payment calculator can help you decide what the best. Web Your monthly payment is 107771 under a 30-year fixed-rate mortgage with a 35 interest rate. Web The median annual property tax homeowners in Chittenden County pay is 6376 highest in the state and more than double the national average.

You may deduct interest payment amounts made on your. Web The calculator takes the following standard mortgage costs into account when calculating your payment. Web In fact lenders often require monthly property tax payments for homeowners who put down less than 20 percent of the buying price for their down payment.

Web With minimum down payments commonly as low as 3 its easier than ever to put just a little money down. Governments typically send an annual bill for your property taxes but if your mortgage includes escrow your. If the borrowers make a down.

Ad Near Historic Low Rates Can Help Lower Your Payment. Web According to the 2836 rule your mortgage payment -- including taxes homeowners insurance and private mortgage insurance -- shouldnt go over 28. How much youll pay each month toward your.

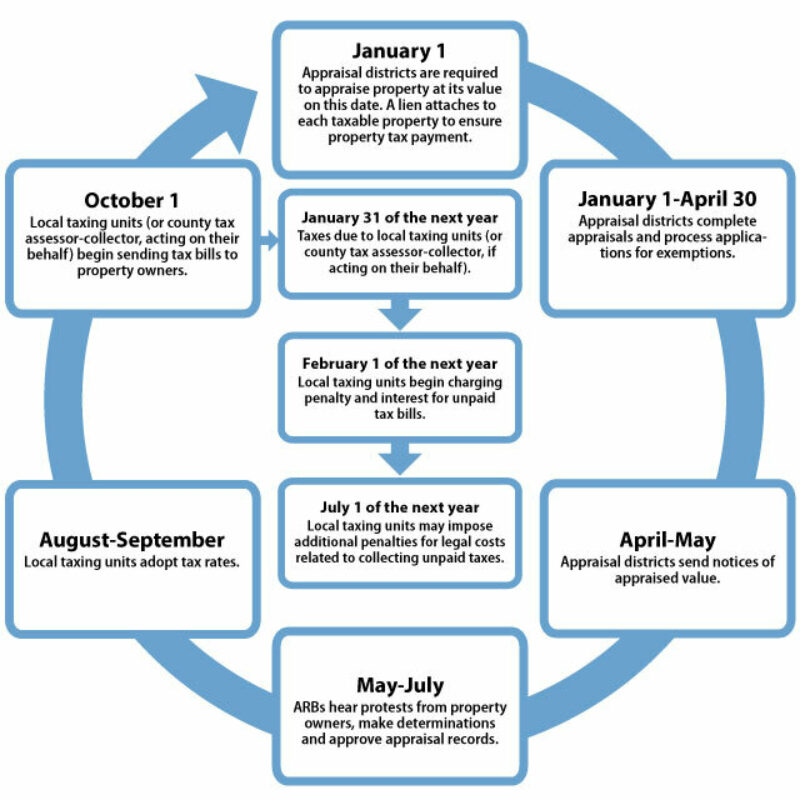

Web A property tax is a levy on property that the owner is required to pay with rates set as a percentage of the home value. However lenders dont control this cost.

Key Insights For Leasing Industry Professionals By E Greenews Distribution Issuu

Annual Report 2003 2004

1105 County Road 3605 Bullard Tx 75757 For Sale Mls 20277768 Re Max

Real Estate Weekly Issue 20 By Lehigh Valley Association Of Realtors Issuu

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Where Have Property Taxes Increased The Most Valuepenguin

Late Tax Bills Result In Higher Mortgage Payments For Some Oak Park

How To Calculate Property Tax 10 Steps With Pictures Wikihow

5 Documents Home Buyers Need To Save Cash At Tax Time Tax Time Real Estate Tips Tax

Open Esds

Are Property Taxes Included In Mortgage Payments Smartasset

All About Property Taxes When Why And How Texans Pay

Tax Sale Types Of Tax Sale With Advantages And Disadvantages

See How Well Your Mortgage Interest Deduction Stacks Up Compared To The Rest Of The Country

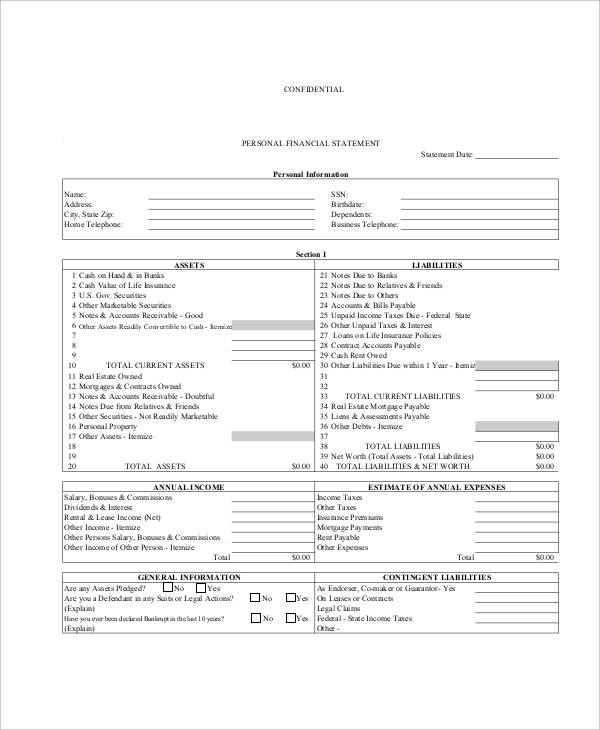

35 Financial Statement Examples Annual Small Business Personal Examples

Property Taxes Everything You Need To Know Uhm